europe-tula.ru

Overview

What Do You Need To Open A Pnc Checking Account

Personal checking customers must not currently have a PNC Bank consumer checking account and must not have closed an account within the past 90 days. What do I need to open a new checking account? · Your legal name · Social Security number or tax identification number · Date of birth · Occupation · Email address. To start an application, we will need: Your business's Tax Identification Number; A valid email address, if applying online; Access to a printer if applying. You should be able to close your savings account without closing your credit card. The PNC HYSA also seems to have no fees, so I'm not sure why. Many banks have checking and/or savings accounts designed for college students, which often feature lower or no monthly fees, lower minimum balance requirements. Students, you have the option to open an account with PNC Bank. You may then choose to link your PNC account to your i-card. What you need to take to the branch: · A government-issued photo ID and secondary form of identification from either of the primary or secondary ID lists below. Everything you need in a checking account to focus on building towards your goals tomorrow without the worry of overdraft fees. Applicants will need their Social Security number and a valid U.S. Driver's license or a state or military ID for verification. Additional forms of ID may be. Personal checking customers must not currently have a PNC Bank consumer checking account and must not have closed an account within the past 90 days. What do I need to open a new checking account? · Your legal name · Social Security number or tax identification number · Date of birth · Occupation · Email address. To start an application, we will need: Your business's Tax Identification Number; A valid email address, if applying online; Access to a printer if applying. You should be able to close your savings account without closing your credit card. The PNC HYSA also seems to have no fees, so I'm not sure why. Many banks have checking and/or savings accounts designed for college students, which often feature lower or no monthly fees, lower minimum balance requirements. Students, you have the option to open an account with PNC Bank. You may then choose to link your PNC account to your i-card. What you need to take to the branch: · A government-issued photo ID and secondary form of identification from either of the primary or secondary ID lists below. Everything you need in a checking account to focus on building towards your goals tomorrow without the worry of overdraft fees. Applicants will need their Social Security number and a valid U.S. Driver's license or a state or military ID for verification. Additional forms of ID may be.

To open a checking account, you must provide government-issued identification with your photo, your Social Security card or Taxpayer Identification Number, and. I asked if the name of the company attempting to remove funds could be flagged, or if we should just close our account and open a new one. Every representative. This Agreement defines the relationship between you (the account holder) and us (PNC Bank). We think it will help you understand your account better and. learn more about PNC Bank open a virtual wallet student account Our message to families For additional information, or if you need to apply for a bank account. There is no minimum opening deposit. The $25 monthly fee is waived if you meet one of these criteria: Monthly direct deposits of $5, a month to your Spend. In fact, you can even use your id+ card as an ATM card when you link it to your PNC account! There's no charge to link, and it's easy to do online. To learn. account via online transfers do not qualify as automatic payments. PNC WorkPlace Banking checking account must remain open in order for you to receive the. What are the requirements to open a student bank account with PNC. You can open a PNC student account if you're over 16 and have a US government issued ID. If. Depending on the account you're trying to open, you'll find different fees for PNC banking products. PNC requires a $25 minimum opening deposit for their. Eligible PNC Bank account and PNC Bank Online Banking required. Certain PNC WorkPlace Banking checking account must remain open in order for you to. You do not need a Social Security number to open a bank account at most banks. • You do need a Social Security number to apply for a credit card, loan or. you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required. Certain other restrictions apply. See the mobile. How Old Do You Have to Be to Open a Bank Account? What Do You Need To Open a Bank Account · Contingent vs. Pending: Understanding the Differences · How Long. No minimum opening balance requirements if you open online; 5 USD out of 18]Chime - What do I need to know about the Chime Savings Account? 19)Citi. A student savings account with tools to start you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required. What You Need to Know: · Minimum deposit to open: $0 · Minimum to earn interest: $1 · Monthly Service charge of $5, or $0 if one of the following is met: Average. Opening an account is easy In compliance with Department of Education regulation CFR – , we are required to post the following. you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required. Certain other restrictions apply. See the mobile. online transfers do not qualify as automatic payments. PNC WorkPlace Banking checking account must remain open in order for you to receive the $ reward. PNC is back with a competitive welcome bonus for opening a personal checking account online and meeting direct deposit requirements within the first 2 months.

Online Blackjack Real Money New York

Real money online casinos are not available in New York, but players can legally enjoy sweepstakes casinos and social casinos safely from anywhere in the. Best Blackjack Games to Play for Real Money Online · 1. European Blackjack · 2. Atlantic City Blackjack · 3. Live Dealer Blackjack · 4. American Blackjack · 5. Las. New York online casinos are not yet legal. However, you can still legally play at social and sweepstakes NY gambling sites. Use our shortlist to find your. Things to DoCasinos & GamblingResorts World New York City. Search real folks putting a big money wager on a number. Nothing of the sort is available at. In New York, online casinos are still illegal. As of , New York decided to legalize online sports betting. This left a lot of players wondering if online. With the online casinos reviewed on this page regulated overseas, New Yorkers are not breaking any laws by using them to play real money blackjack. As stated in. What is DraftKings Casino? An established, regulated online casino — licensed and regulated by state regulators to ensure a fair online gaming experience. The. On one hand, land-based options, racetracks, lotteries, and sports betting are legal, while on the other hand, online casinos are not at the moment. However. BetUS is the top online blackjack site for New York players. There are 17 virtual blackjack games, including multi-hand, single deck, double deck, Spanish. Real money online casinos are not available in New York, but players can legally enjoy sweepstakes casinos and social casinos safely from anywhere in the. Best Blackjack Games to Play for Real Money Online · 1. European Blackjack · 2. Atlantic City Blackjack · 3. Live Dealer Blackjack · 4. American Blackjack · 5. Las. New York online casinos are not yet legal. However, you can still legally play at social and sweepstakes NY gambling sites. Use our shortlist to find your. Things to DoCasinos & GamblingResorts World New York City. Search real folks putting a big money wager on a number. Nothing of the sort is available at. In New York, online casinos are still illegal. As of , New York decided to legalize online sports betting. This left a lot of players wondering if online. With the online casinos reviewed on this page regulated overseas, New Yorkers are not breaking any laws by using them to play real money blackjack. As stated in. What is DraftKings Casino? An established, regulated online casino — licensed and regulated by state regulators to ensure a fair online gaming experience. The. On one hand, land-based options, racetracks, lotteries, and sports betting are legal, while on the other hand, online casinos are not at the moment. However. BetUS is the top online blackjack site for New York players. There are 17 virtual blackjack games, including multi-hand, single deck, double deck, Spanish.

Wondering which states allow online casino gambling for real money? Online casino games are legal to play in MI, PA, NJ, WV, and CT with FanDuel Casino. States. New York is probably one of the states that are furthest behind when it comes to legalizing any forms of online gambling. There's even a bill still waiting. New York online casinos still remain unlawful and outside the legal framework imposed by local lawmakers. Residents in the state do have. It is now completely legal for residents of New York to gamble for real money online. New Yorkers can bet on their favorite sports teams, or check out online. The best place to play online Blackjack, online Roulette and other online table games. Play land-based casino Slots and online exclusives like 2 Tribes. If you or someone you know has a gambling problem, call GAMBLER. rg-mgm · nj-dge. Approved for real money gaming, New Jersey. Accessibility. BetMGM. Responsible Gambling in New York · Fanatics · BetMGM · Caesars Palace Online Casino · FanDuel · Golden Nugget · bet · Hollywood · BetRivers. Experience the best Casino in Las Vegas at New York New York Casino. Enjoy The ultimate online sports betting experience awaits. Download the. casino's offerings and potentially win real money without any initial investment. Whether you're a seasoned player or new to online casinos, taking advantage. Types Of New York Real Money Online Casino Games Online casino gambling is not currently legal in New York state. Once these sites are approved and are. NY online casinos are illegal, but New York is home to retail casinos, including tribal venues and racinos. Slots and table games are available at most. New York online casinos have yet to be legalized, but local players have some options, including social and sweepstakes casinos. These sites offer slot machines. Resorts World New York City is the only casino in NYC, offering guests an unparalleled gaming and entertainment experience. With over of the most. Make BetMGM your one-stop online casino. % Deposit Match Welcome Offer. Slots, Blackjack, Roulette, Craps & Live Dealer Experience. As the name suggests, online blackjack is simply a virtual version of the popular card game. Blackjack is one of the most well-loved casino games, due to it. Let's face it, it's going to be a long time before real-money online casino gaming gets legalized in New York. This means that europe-tula.ru is easily your best. FanDuel Casino is the #1 Rated Online Casino app, where you can play fully regulated online casino games for real money in Michigan, Pennsylvania, New Jersey. As the name suggests, online blackjack is simply a virtual version of the popular card game. Blackjack is one of the most well-loved casino games, due to it. The leader in sports entertainment tech has another all-star on its roster. Meet DraftKings Blackjack. Hit, stay, double down, win. Anytime. Anywhere. It.

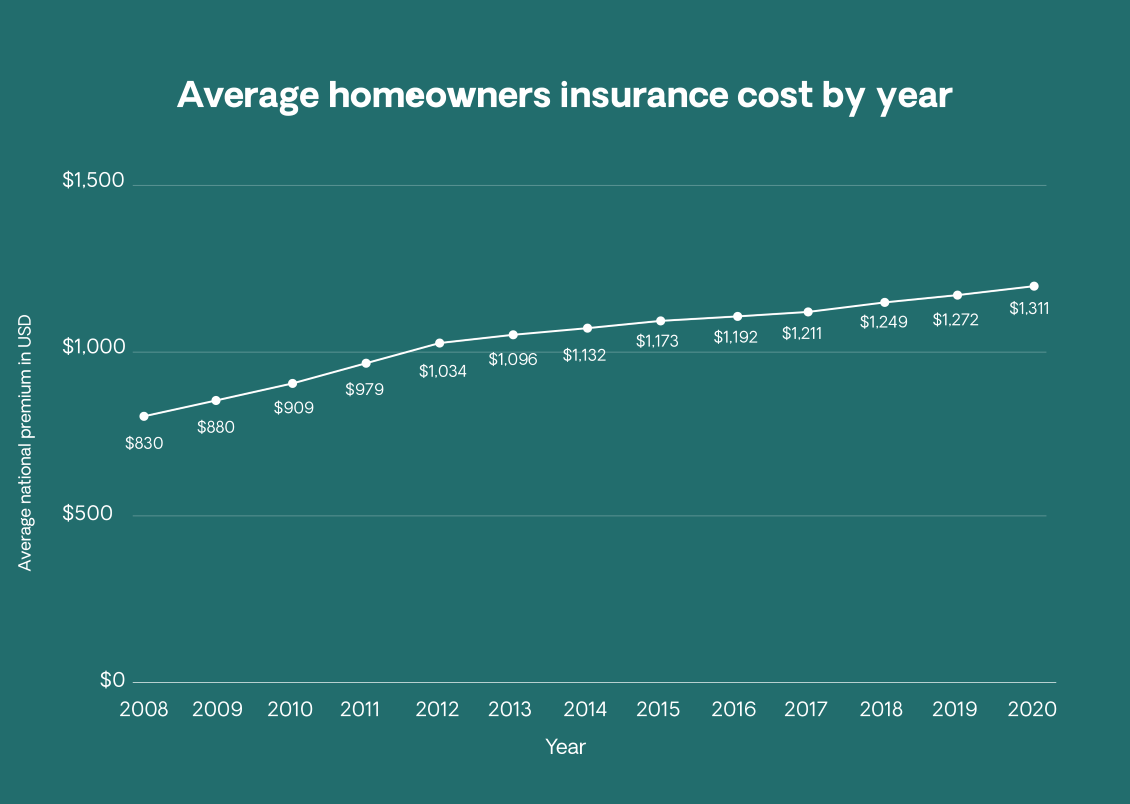

How Much Should Home Insurance Cost Per Year

The national average cost of homeowners insurance is $2, per year for $, in dwelling coverage, but this cost will likely differ depending on which. The national average homeowners insurance cost is $ and has been steadily increasing each year. ✓ Get details and learn how to keep costs down! The average annual homeowners insurance premium runs about $1, However average of $3, for home insurance each year, the highest in the nation. should make sure you review and update your coverage every year. Check home replacement cost, this amount may not be enough in the future. To help. When considering the approximate cost of homeowners insurance, it's essential to factor in the In British Columbia, the average cost of home insurance varies. This guide lists annual rates for four typical homeowners policies. The companies listed are those with the largest market share in Oklahoma that responded to. “The First State” checks in at third for most expensive states to insure a home in, with average annual rates of $1, Budgeting for the monthly cost of. Unless you're Nostradamus, it's impossible to predict what the exact cost will be to replace your home in the future. It's important to have enough coverage to. The average cost of home insurance in the U.S. ranges from $1, to $2, per year, based on our analysis of rates for policies with dwelling coverage limits. The national average cost of homeowners insurance is $2, per year for $, in dwelling coverage, but this cost will likely differ depending on which. The national average homeowners insurance cost is $ and has been steadily increasing each year. ✓ Get details and learn how to keep costs down! The average annual homeowners insurance premium runs about $1, However average of $3, for home insurance each year, the highest in the nation. should make sure you review and update your coverage every year. Check home replacement cost, this amount may not be enough in the future. To help. When considering the approximate cost of homeowners insurance, it's essential to factor in the In British Columbia, the average cost of home insurance varies. This guide lists annual rates for four typical homeowners policies. The companies listed are those with the largest market share in Oklahoma that responded to. “The First State” checks in at third for most expensive states to insure a home in, with average annual rates of $1, Budgeting for the monthly cost of. Unless you're Nostradamus, it's impossible to predict what the exact cost will be to replace your home in the future. It's important to have enough coverage to. The average cost of home insurance in the U.S. ranges from $1, to $2, per year, based on our analysis of rates for policies with dwelling coverage limits.

The cost of homeowners and tenants insurance Upon your request, your insurer must review your current credit information at least once every 3 years. For example, Florida residents pay the highest average premiums, at $2, per year, according to III data, while Oregon residents pay an average of just $ Home insurance rates average $2, per year for a policy with $, in dwelling coverage, $, in personal property coverage and $, in personal. The Average home insurance cost in Ottawa is around $1, per year or $ per month for your premium. average for Ontario, which stands at around $1, per. The national average homeowners insurance cost is $ and has been steadily increasing each year. ✓ Get details and learn how to keep costs down! $ a month, yes, that sounds reasonable per month, maybe a little high on a home that costs that much. I'd shop. Totally depends on where you live. It depends. These are some of the factors that may help determine how much you'll end up paying for homeowners insurance: The deductible you choose. How much does home insurance cost? Where you live can make a big difference in how much you will pay. In fact, the difference in annual costs between the most. Discover the right level of insurance for you ; How much would it cost to rebuild your home? · much would it cost to replace. A one bedroom property costs £ on average to insure, but that goes up to £ for a four bedroom home, a 70% increase. Monthly vs. annual payments. It's. Average homeowners insurance in NY. The average price of home insurance in New York varies depending on where you live. The following is the average annual cost. Home insurance rates average $2, per year for a policy with $, in dwelling coverage, $, in personal property coverage and $, in personal. europe-tula.ru's analysis of rates from top insurers for every state and nearly every city — down to the ZIP code — found the average annual cost of homeowners. home insurance coverage you have plays a significant role in your costs coverage limits or personal property limits can increase how much you pay annually. For a quick estimate of the amount of insurance you need, multiply the total square footage of your home by local, per-square-foot building costs. On average, homeowners insurance in the U.S. costs about $2, per year, according to a recent report from Insurify. It covers your home and other structures. What is the average cost of homeowners insurance? Nationwide, the average homeowners insurance premium is $1, annually, or approximately $ a month. What are average Home Insurance cost in Toronto? Avg. Monthly Home Home insurance rate: $38 per month ($/year). Toronto home insurance quote. $ a month, yes, that sounds reasonable per month, maybe a little high on a home that costs that much. I'd shop. Totally depends on where you live. Many people can expect their homeowners insurance rates to go up this year As weather-related damages go up, so does the cost of insurance overall.

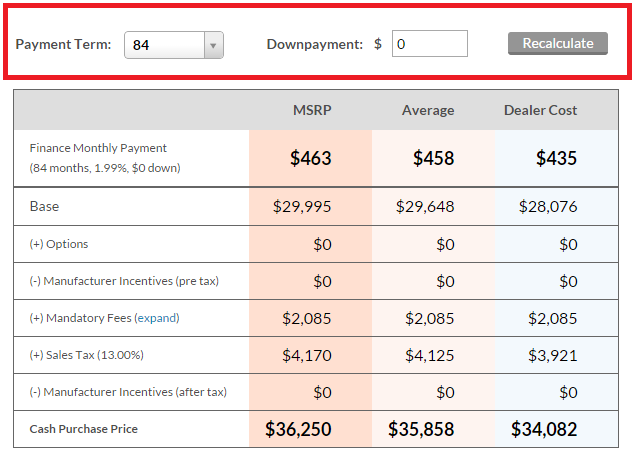

How Do I Calculate My Monthly Car Payment

This car loan calculator will help you visualize how changes to your interest rate, down payment, trade-in value, and vehicle price affect your loan. Use our financing payment calculator to estimate your monthly payment for a new or used vehicle you buy at a dealership. Enter a few details in the. Our free car loan calculator generates a monthly payment amount and total loan cost based on vehicle price, interest rate, down payment and more. The first calculator figures monthly automotive loan payments. To help you see current market conditions and find a local lender current Mountain View auto. The size of your monthly payment depends on loan amount, loan term, and interest rate. Loan amount equals vehicle purchase price minus down payment. Estimate your monthly vehicle payments effortlessly with our car calculator. Input your details to get a quick payment estimate. Skip the guesswork! Estimate your monthly payments with europe-tula.ru's car loan calculator and see how factors like loan term, down payment and interest rate affect payments. Calculating your monthly payment can make the loan preapproval process easier and help you work your new car into your budget · Your monthly car payment amount. Estimate your monthly payment by entering your loan amount, Annual Percentage Rate (APR), and loan term length. This car loan calculator will help you visualize how changes to your interest rate, down payment, trade-in value, and vehicle price affect your loan. Use our financing payment calculator to estimate your monthly payment for a new or used vehicle you buy at a dealership. Enter a few details in the. Our free car loan calculator generates a monthly payment amount and total loan cost based on vehicle price, interest rate, down payment and more. The first calculator figures monthly automotive loan payments. To help you see current market conditions and find a local lender current Mountain View auto. The size of your monthly payment depends on loan amount, loan term, and interest rate. Loan amount equals vehicle purchase price minus down payment. Estimate your monthly vehicle payments effortlessly with our car calculator. Input your details to get a quick payment estimate. Skip the guesswork! Estimate your monthly payments with europe-tula.ru's car loan calculator and see how factors like loan term, down payment and interest rate affect payments. Calculating your monthly payment can make the loan preapproval process easier and help you work your new car into your budget · Your monthly car payment amount. Estimate your monthly payment by entering your loan amount, Annual Percentage Rate (APR), and loan term length.

Estimate your monthly car payment with our payment calculators. Ready to take the next step? Get pre-qualified with no impact to your credit score. Auto loans are pretty simple once you break them down. You can apply for one from a bank, credit union, or other lending institutions – your car dealer can even. Once you enter all the information below, click “Calculate” and you'll be shown a breakdown of your monthly payment, along with information about how much you'. This calculator shows you possible savings by using an accelerated biweekly payment on your auto loan. By paying half of your monthly payment every two weeks. Enter a total loan amount into this auto loan calculator to estimate your monthly payment, or determine your loan amount by car price, trade-in value and other. Our simple Monthly Car Payment Calculator makes it easy to figure out how your next car purchase will fit into your monthly budget. Our car payment calculator will give you a trustworthy estimate of what you can expect your monthly vehicle payments to be. It's that simple! Calculating Auto Loan Payments · Use the formula A = P ∗ (r (1 + r) n) / ((1 + r) n − 1) {\displaystyle A=P*(r(1+r)^{n})/((1+r)^{n}-1)} · A = the monthly. Use Carvana's auto loan calculator to estimate your monthly payments. See how interest rate, down payment & loan term will impact your monthly payments. Use our online payment calculator to find out how much your monthly car payments would be on a new vehicle. Once you find out, you can set a monthly budget. Your monthly car payment is based on the loan amount, the loan term and the interest rate for the loan. Loan amount is based on the net purchase price of. Purchase Price: It is recommended that the monthly auto loan payment alone is limited to about 10% to 15% of your after-tax take-home pay. A lower purchase. Use Carvana's auto loan calculator to estimate your monthly payments. See how interest rate, down payment & loan term will impact your monthly payments. There's no perfect formula for how much you can afford, but our short answer is that your new-car payment should be no more than 15% of your monthly take-home. Car Finance Payment Calculator · Vehicle Price: Whether you have found your perfect vehicle or you simply know what you are looking to spend on a new vehicle. Auto loans are pretty simple once you break them down. You can apply for one from a bank, credit union, or other lending institutions – your car dealer can even. Average interest rate for a car loan. In Q1 , the average interest rate for a new car was % and % for a used car, according to Experian. When it. Edmunds Lease Calculator will help you estimate your monthly car payment on a new car or truck lease. Average interest rate for a car loan. In Q1 , the average interest rate for a new car was % and % for a used car, according to Experian. When it. Use the "Fixed Payments" tab to calculate the time to pay off a loan with a fixed monthly payment. For more information about or to do calculations specifically.

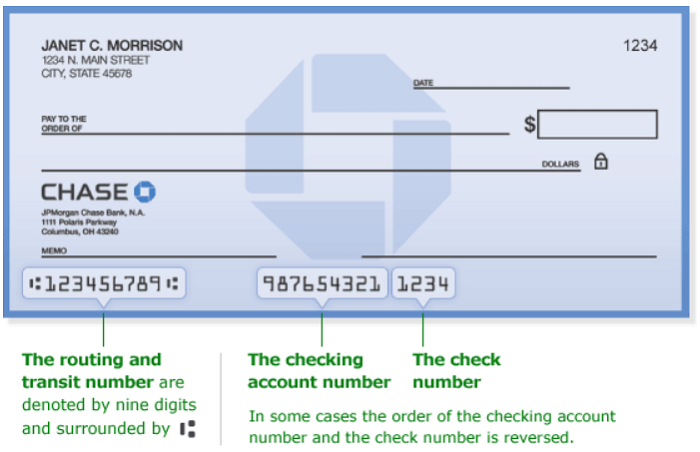

How To Cash A Check Online With Chase

Looking for how to deposit your paper checks with a mobile app? Check out our easy and secure option to cash your checks online with Chase QuickDeposit℠. You can see images of checks you've written for up to three years online when you sign in to your account on europe-tula.ru Once a check has cleared. Step one Sign in to the Chase Mobile® app and tap "Pay & Transfer" · Step two Select "Deposit checks" and choose the account where you want your deposit to go. You can see images of checks you've written for up to three years online when you sign in to your account on europe-tula.ru Once a check has cleared. A voided check is a crucial document used for various financial purposes, including setting up direct deposit. It provides the necessary. When do checks clear? By law, banks are required to make at least the first $ of a personal check deposit available for use by the next business day. Find the mobile deposit section: Once logged in, there will typically be an option on your home screen labeled “Mobile deposit,” “Deposit checks” or something. You can also review returns and adjustments online. Search for a Check or Deposit. To begin, click “Search for checks & deposits” on the Chase. Quick Deposit. Step one Sign in to your account · Step two Choose "Collect & deposit", then choose "Deposit Checks" · Step three Enter deposit details, then load check(s) into. Looking for how to deposit your paper checks with a mobile app? Check out our easy and secure option to cash your checks online with Chase QuickDeposit℠. You can see images of checks you've written for up to three years online when you sign in to your account on europe-tula.ru Once a check has cleared. Step one Sign in to the Chase Mobile® app and tap "Pay & Transfer" · Step two Select "Deposit checks" and choose the account where you want your deposit to go. You can see images of checks you've written for up to three years online when you sign in to your account on europe-tula.ru Once a check has cleared. A voided check is a crucial document used for various financial purposes, including setting up direct deposit. It provides the necessary. When do checks clear? By law, banks are required to make at least the first $ of a personal check deposit available for use by the next business day. Find the mobile deposit section: Once logged in, there will typically be an option on your home screen labeled “Mobile deposit,” “Deposit checks” or something. You can also review returns and adjustments online. Search for a Check or Deposit. To begin, click “Search for checks & deposits” on the Chase. Quick Deposit. Step one Sign in to your account · Step two Choose "Collect & deposit", then choose "Deposit Checks" · Step three Enter deposit details, then load check(s) into.

Bank securely with the Chase Mobile® app: send and receive money with Zelle®, deposit checks, monitor credit score, budget and track income & spend. Hi everyone, I deposited a check of $ yesterday using the mobile deposit on my chase app, they said it would be ready today. Yes you can, but you must have bank account in bank of America. You can also cash your check with other institutions. For example, Walmart cashing center. 5 Chase receives time and date information for everyday debit card transactions, ATM withdrawals, online banking transactions, teller cash withdrawals, cashed. The traditional way to deposit a check is to visit your local bank branch. After endorsing your check, you can fill out a deposit slip, include the check and. Save a trip to the branch and mobile deposit checks in a snap. Just take a picture of your check on your mobile phone or tablet, confirm the details, and submit. deposit accounts in JPMorgan Chase online and mobile banking. Both your Chase deposit account number, you can find it on your First Republic checks. Access the app on your smart phone, write on the back of check “Mobil deposit only”, sign it, app will take you to photo page where you take. If you don't have a bank account and someone gives you a check drawn on a Chase account, you can cash it by going in person to your local Chase. View statements, check images and deposit slip images using our online service1. 1 Fees, terms, conditions and limitations apply as described in the legal. You can take it to any Chase branch and they will cash it. If it's over $, they will require a second form of ID in addition to a photo ID. Sign in to europe-tula.ru or the Chase Mobile® app · Choose the checking account you want to receive your direct deposit · Navigate to 'Account services' by scrolling. Bank nationwide from wherever your business takes you. Use the Chase Mobile® app FootnoteOpens overlay, FootnoteOpens overlay to securely deposit checks. Chase QuickDeposit℠ via the J.P. Morgan Mobile app: for mobile check deposits · Sign in to the J.P. Morgan Mobile app · Tap "Pay & Transfer" · Tap "Deposit checks". Step-by-Step Guide to Using Chase QuickDeposit · Log in to the Chase mobile app with your username and password. · Tap “Deposit Checks” from the navigation menu. Mobile Deposit – use the Chase Mobile app to deposit checks; Single Feed Check Scanner – when depositing fewer than 15 checks per week; Multiple Feed Check. Deposit checks from almost anywhere with the Bank of America Mobile Banking app Footnote[1] on your smartphone or tablet. Insert the installation disk for the Chase Quick Deposit scanner into your computer's CD-ROM. · Log in to your online Chase Business account. · Click the "Quick. You can cash it at any Chase Bank facility or any facility that cashed checks. Just make sure you have ID available and the phone number of. Do more with the Chase Mobile® app Scan the QR code to download the app to experience convenience and security on the go. Online Bill Payment: You must be.

Lgbt Friendly Banks

The LGBTQ+ Pride program, launched in , is a company-supported Employee Network that combines the LGBTQ+ groups from Bank of America and Merrill. Helping. Wider access to loans and lines of credit through Special Purpose Credit Program underwriting guidelines can assist LGBTQ business owners who might. LGBTQ+ people should be assured basic rights and the ability to live safely and openly. Find out how Amalgamated has taken a stand to support LGBTQ+ rights. California Cryobank · Fairfax Cryobank · Midwest Sperm Bank · NW Cryobank · Pacific Reproductive Services. LGBT Fertility Resources. LGBT Fertility Resources. Banks that take steps to promote inclusion and reduce discrimination against LGBTQI+ communities include Amalgamated Bank, Capital One, JPMorgan Chase, TD Bank. Category: BANKING/INSURANCE/FINANCIAL · Charise Karjala Health Markets · Wiefels Funeral Home · HR Simplistic · Contempo Lending · Barton CPA Palm Springs. Superbia is a new financial leader devoted to our LGBTQ community. Your safe space in financial services for banking, lending, life & health insurance. Monzo are probably the best;. They allow any name on the card and iirc they don't log gender/titles in their system (all their. Hi, I'm going to ditch my bank soon and get an account with a credit union. There's a lot near me, but I don't know if any are especially. The LGBTQ+ Pride program, launched in , is a company-supported Employee Network that combines the LGBTQ+ groups from Bank of America and Merrill. Helping. Wider access to loans and lines of credit through Special Purpose Credit Program underwriting guidelines can assist LGBTQ business owners who might. LGBTQ+ people should be assured basic rights and the ability to live safely and openly. Find out how Amalgamated has taken a stand to support LGBTQ+ rights. California Cryobank · Fairfax Cryobank · Midwest Sperm Bank · NW Cryobank · Pacific Reproductive Services. LGBT Fertility Resources. LGBT Fertility Resources. Banks that take steps to promote inclusion and reduce discrimination against LGBTQI+ communities include Amalgamated Bank, Capital One, JPMorgan Chase, TD Bank. Category: BANKING/INSURANCE/FINANCIAL · Charise Karjala Health Markets · Wiefels Funeral Home · HR Simplistic · Contempo Lending · Barton CPA Palm Springs. Superbia is a new financial leader devoted to our LGBTQ community. Your safe space in financial services for banking, lending, life & health insurance. Monzo are probably the best;. They allow any name on the card and iirc they don't log gender/titles in their system (all their. Hi, I'm going to ditch my bank soon and get an account with a credit union. There's a lot near me, but I don't know if any are especially.

Results: 10 · Amegy Bank of Texas · Cadence Bank · Bank of America · JPMorgan Chase · PNC Bank · Regions Bank · Wells Fargo · Federal Reserve Bank of Dallas. Established in as Harris Bank, and owned by BMO Financial Group since , BMO Harris Bank has grown to become one of the largest banks in the Midwest. JPMorgan Chase executives shake hands with the owners of LGBTQ (plus)-friendly fitness centers and bar-and-grills. A rainbow-colored neon sign reads: "Open. The National LGBT Chamber of Commerce The business voice of the LGBTQ community. We are the largest advocacy organization dedicated to expanding economic. U.S. Bank partners with nonprofits across the country to support LGBTQ+ events and businesses. Here are a handful of our partners and the work we do with them. Element has a rainbow of banking options to help our 2SLGBTQIA+ community live better financial lives. We create custom 2SLGBTQIA+ Banking solutions just for. Followers, Following, 83 Posts - Gay Travel — Out on the Outer Banks 🏝️ (@outontheobx) on Instagram: "🏳️ The gay and LGBT-friendly OBX. Learn about how TD Bank celebrates the LGBTQ2+ community and our history, like being the first North American bank to offer same-sex partner benefits. Support for transgender colleagues We are committed to providing a safe and supportive working environment for all colleagues and the way in which they wish. The Daughters of Bilitis, a Wells Fargo customer, established the first national organization for lesbian women, creating a community of shared experience. Here are a few key organizations we've partnered with to make sure that happens. Human Rights Campaign · Massachusetts Transgender Political Coalition · Gay For. Regions Bank and Regions Foundation invest in helping individuals, families and businesses overcome financial challenges. Both the bank and the foundation are. LGBTQ customers have specialized needs, so we tailor our financial products and services to meet them. Our commitment doesn't stop there: We contribute to. Tucson LGBT Chamber of Commerce | Banks and Credit Unions. We use cookies to ensure that we give you the best experience on our website. Results: 10 · Amegy Bank of Texas · Cadence Bank · Bank of America · JPMorgan Chase · PNC Bank · Regions Bank · Wells Fargo · Federal Reserve Bank of Dallas. Over a year after Mastercard announced the "True Name" initiative, Citi is the first major bank to provide card members with the ability to choose the name. Banks Ave. (South Slope). LGBTQ friendly business Banks Ave Bar hosts a drag show. Photo by Authentic Asheville. CW: You can pop into Banks Ave any day of the. Results: 39 · Amegy Bank of Texas · alliantgroup · Cadence Bank · Bank of America · JPMorgan Chase · PNC Bank · Regions Bank · Wells Fargo. Established in as Harris Bank, and owned by BMO Financial Group since , BMO Harris Bank has grown to become one of the largest banks in the Midwest. Deutsche Bank recognized for LGBTQ leadership. Deutsche Bank earned a perfect on Human Rights Campaign's annual Corporate Equality Index, reaffirming its.

Delta Skymiles Credit Card Travel Insurance

Delta SkyMiles Credit Cards Benefits and Perks ; Rewards. 2 miles per dollar on Delta purchases, at restaurants worldwide, and takeout and delivery in the U.S. Delta SkyMiles® Gold American Express Card: Superb Travel Benefits and High Rewards · Earn 40, Bonus Miles after spending $2, in eligible purchases within. Trip Delay Insurance can help reimburse certain additional expenses purchased on the same Eligible Card, up to $ per trip, maximum 2 claims per eligible. Elevate your travel experience with an annual statement credit Travel℠, No Foreign Transaction Fees and Trip Cancellation/Trip Interruption Insurance. First and last name on credit card must match with name on SkyMiles account provided. insurance costs are excluded from mileage credit. Miles will not. Delta often. Apply now: Delta SkyMiles® Gold American Express Card. Summary of the credit cards for travel insurance. *Updated as of February Credit Card. There's only one card that takes you places with your preferred airline, the Delta SkyMiles Personal Credit Card from American Express. Delta Amex card features ; Delta SkyMiles® Platinum Business American Express Card, up to $ Resy Credit ($10 per month) up to $ Rideshare Credit ($10 per. Find international options for Delta SkyMiles Credit Cards. Use your card abroad to earn miles on everyday purchases and with Delta. Delta SkyMiles Credit Cards Benefits and Perks ; Rewards. 2 miles per dollar on Delta purchases, at restaurants worldwide, and takeout and delivery in the U.S. Delta SkyMiles® Gold American Express Card: Superb Travel Benefits and High Rewards · Earn 40, Bonus Miles after spending $2, in eligible purchases within. Trip Delay Insurance can help reimburse certain additional expenses purchased on the same Eligible Card, up to $ per trip, maximum 2 claims per eligible. Elevate your travel experience with an annual statement credit Travel℠, No Foreign Transaction Fees and Trip Cancellation/Trip Interruption Insurance. First and last name on credit card must match with name on SkyMiles account provided. insurance costs are excluded from mileage credit. Miles will not. Delta often. Apply now: Delta SkyMiles® Gold American Express Card. Summary of the credit cards for travel insurance. *Updated as of February Credit Card. There's only one card that takes you places with your preferred airline, the Delta SkyMiles Personal Credit Card from American Express. Delta Amex card features ; Delta SkyMiles® Platinum Business American Express Card, up to $ Resy Credit ($10 per month) up to $ Rideshare Credit ($10 per. Find international options for Delta SkyMiles Credit Cards. Use your card abroad to earn miles on everyday purchases and with Delta.

Arguably the most impressive perk is access to Amex Centurion lounges, along with an annual companion ticket that's valid on first-class travel. Card details. New! $ Delta Stays Credit: Delta SkyMiles® Gold American Express Card Members can earn up to $ back annually on eligible prepaid Delta Stays bookings on. Apply for one of our travel credit cards and partner airline rewards credit cards to begin earning travel rewards that are simple to earn and redeem. Answer 11 of I rarely fly on airlines other than Delta, so if I do choose to add an airline credit card to my wallet, it may make sense for me to get a. With the Travel Protection Plan, you're provided with pre- and post-departure coverage. We offer two travel protection options for you to choose from. Benefits. /5. Overall Rating. The Bottom Line. Top Category. Most co-branded airline credit cards only offer bonus miles for spending on their own flights. With the Delta Gold SkyMiles credit card, you're getting that first checked bag fee waived, meaning you can rack up some serious savings each year, well in. With every Delta SkyMiles Business Card, you'll receive Card Member benefits that help you earn miles and enhance your travel experience. EMPLOYEE CARDS. Add. travel benefits with SkyMiles partners— like Hertz® Car Rental. First and last name on credit card must match with name on SkyMiles account provided. No long lines and first ones on the plane – that's how I like it! New Benefits! new bonuses. $ Delta Flight Credit. Here is another reason to use this card. If your trip is canceled or interrupted for a covered reason, you can receive a maximum of $10, per covered trip and a maximum of $20, per eligible card. SkyMiles Credit Card to use in your country of residence. |Travel may be on other airlines. Terms and conditions apply to all offers and SkyMiles benefits. Travel Protection Plan · Create a new reservation with lower price and place on hold. · Create a new reservation and confirm with credit card. · The Travel. This premium travel card is packed with perks. And you can earn 60, bonus miles (worth about $) after you spend $5, in purchases on your new Card in. New! $ Delta Stays Credit: Delta SkyMiles® Gold American Express Card Members can earn up to $ back annually on eligible prepaid Delta Stays bookings on. Travel benefits include a free checked bag on Delta flights for you and up to nine other passengers on your reservation, priority boarding, a global assistance. The Delta SkyMiles Gold American Express Card, on the other hand, offers basic travel perks like baggage insurance, priority boarding, and purchase protection. AMEX Baggage Insurance - Tier 1 Cover. Amex Blue; Amex Green; Amex One; Amex Gold; Amex Platinum; EveryDay Preferred; Gold Delta SkyMiles; Platinum Delta. The cards also have their own set of bonus rewards categories and ongoing benefits. No matter what your budget or travel preferences are, there's likely to be a. insurance, from the Amex Platinum Card to the Delta SkyMiles Reserve Card. This type of travel insurance covers trip delays due to: lost or stolen travel.

Money Market Account Vs Savings Account

:max_bytes(150000):strip_icc()/why-would-you-keep-funds-money-market-account-and-not-savings-account-ADD-Color-V3-e17a68d37eb9437eba385eb0c6452f49.jpg)

Money market accounts tend to offer better interest rates and flexibility, while savings accounts typically have lower initial deposit and balance requirements. A money market savings account pays a higher rate of interest than a basic savings account. Banks usually require a higher minimum balance for this type of. But while money market accounts typically have higher opening deposit requirements than everyday savings accounts, they reward you with higher interest rates. A money market account is a close cousin to a traditional savings account, but typically offers a higher interest rate and requires a higher balance. When it comes to having quick and easy access to your cash, money market accounts beat high-yield savings accounts because of their check-writing capabilities. Interest rates. Comparing a savings account vs. money market account, MMAs have higher interest rates compared to traditional savings accounts. On the other. Money market accounts are offered by banks and credit unions and provide the benefits and features of both savings and checking accounts. · They generally pay. Money market accounts are interest-bearing savings accounts through financial institutions, while money market mutual funds are low-risk investment funds. Why would you chose a traditional savings account compared to a Money Market Account? Besides a higher minimum balance is there any other. Money market accounts tend to offer better interest rates and flexibility, while savings accounts typically have lower initial deposit and balance requirements. A money market savings account pays a higher rate of interest than a basic savings account. Banks usually require a higher minimum balance for this type of. But while money market accounts typically have higher opening deposit requirements than everyday savings accounts, they reward you with higher interest rates. A money market account is a close cousin to a traditional savings account, but typically offers a higher interest rate and requires a higher balance. When it comes to having quick and easy access to your cash, money market accounts beat high-yield savings accounts because of their check-writing capabilities. Interest rates. Comparing a savings account vs. money market account, MMAs have higher interest rates compared to traditional savings accounts. On the other. Money market accounts are offered by banks and credit unions and provide the benefits and features of both savings and checking accounts. · They generally pay. Money market accounts are interest-bearing savings accounts through financial institutions, while money market mutual funds are low-risk investment funds. Why would you chose a traditional savings account compared to a Money Market Account? Besides a higher minimum balance is there any other.

They're both deposit accounts meant for stashing away cash you don't immediately need and both earn more interest than a checking account. A money market is a savings account that usually earns higher dividends than a primary savings account. In this way, it's similar to a certificate. A money market account is like a combination between a checking account and a savings account. These accounts typically offer higher APYs than checking accounts. Money market account vs. certificate of deposit (CD) If you don't need regular access to part of your funds and you still want insurance coverage, check out. A money market account is a type of deposit savings account that accumulates dividends based on the account balance. Accounts earn dividends at a higher rate. Money market accounts are a type of deposit account that earns interest. Rates are often higher than traditional savings accounts. Money market accounts. A money market account is a type of savings account with a higher-than-average interest rate. Money market accounts are a great option if you're saving for a. Everyone needs a savings account. It helps your money grow, and it's there in case of emergency. A money market account is one type of savings account to. Compare savings accounts, money market accounts, interest rates, and financial options to find the best choice. Key benefits to high-yield savings and money market accounts. High-yield savings accounts and money market accounts typically come with higher annual percentage. With a money market account, you earn interest on the money deposited into the account, just like how a savings account works. When opening the account, a. A money market account, sometimes called a money market deposit account or a money market savings account, is an interest-bearing account that acts like a. Money Market Account · Get cash on the go and earn interest while you're at it · Earn interest with a high interest rate account while still being able to access. Money market savings accounts have a higher minimum balance requirement but will earn a higher interest rate than a traditional savings account. Money market accounts typically earn a higher amount of interest than basic savings accounts, making them a good place to store your savings. A money market account is a unique savings account that generally earns you a higher savings rate than traditional savings accounts. Money market accounts can offer higher interest rates while maintaining easy access to your money. Help yourself decide if this savings option is right for. A cash management account, which can offer safety and easy access to your money with higher interest rates than regular savings accounts. A money market fund. So far, they've saved $1, They can open a savings account with no fees and an interest rate of % APY. Or they can open a money market account with an. Money market and checking accounts both allow you to deposit funds through a mobile banking app, make payments or withdraw funds using a debit card, and write.

Price For Servicing A Car

How much should a car service cost? · The average price of a full service is £, according to FixMyCar's data. · For an interim service, the average price is. Having a mechanic replace your radiator typically costs between $ and $1, Not cheap. But cheaper than a new engine. Advertisement. View manufacturer recommended maintenance schedules and repair costs by brand, model and mileage intervals. How much does a car service cost in Australia? Generally, the price for a car service ranges between $ and $ Premium Capped Service. If your vehicle is less than 5 years old, you can enjoy peace of mind with a scheduled service guaranteed at an affordable rate. Know your rights · An estimate – Before beginning any repairs, the auto shop must provide you with an estimate showing the estimated price for parts and labor. Because in order to provide all the services required for your vehicle, they have to buy a lot of expensive specialty equipment, sometimes. Again and again, and again yesterday, I thank the fates that I have a reputable independent mechanic. Walking into the service area of a dealership. Get a free estimate for car repair prices and maintenance costs. Find fair, honest quotes from RepairPal Certified auto repair shops in your area. How much should a car service cost? · The average price of a full service is £, according to FixMyCar's data. · For an interim service, the average price is. Having a mechanic replace your radiator typically costs between $ and $1, Not cheap. But cheaper than a new engine. Advertisement. View manufacturer recommended maintenance schedules and repair costs by brand, model and mileage intervals. How much does a car service cost in Australia? Generally, the price for a car service ranges between $ and $ Premium Capped Service. If your vehicle is less than 5 years old, you can enjoy peace of mind with a scheduled service guaranteed at an affordable rate. Know your rights · An estimate – Before beginning any repairs, the auto shop must provide you with an estimate showing the estimated price for parts and labor. Because in order to provide all the services required for your vehicle, they have to buy a lot of expensive specialty equipment, sometimes. Again and again, and again yesterday, I thank the fates that I have a reputable independent mechanic. Walking into the service area of a dealership. Get a free estimate for car repair prices and maintenance costs. Find fair, honest quotes from RepairPal Certified auto repair shops in your area.

How Much Does a Car Service Cost for My Vehicle? ; MINI. £ £ ; Nissan. £ £ ; Peugeot. £ £ ; Renault. £ £ How much is a fixed price car service? Our fixed price car service packages start at $ for a general car service to keep your car in tip top shape. If you're. Find local trustworthy auto repair professionals. Compare multiple competitive price estimates and book service in a few simple steps. Politely tell the auto technician about your findings and explain why you think their estimate is too high. If they don't lower the price, let them know you'll. On average, basic maintenance costs like oil change and pressure checks won't cost more than $ per year. Replacing parts may cost slightly more – up to $ Choosing a Car Repair Shop You need your car, and when you leave it in the shop for repairs, you can't help worrying about the cost and the quality of the. What affects the cost of a service? It turns out the reason for the difference is that the 40,km/24 month service requires the replacement of the spark. From advanced diagnostics to state-of-the-industry tools and tech specifically designed for your Nissan vehicle, every step of the oil change process has been. The Auto Care Repair Estimator is a quick and easy way to get price estimates for the most common car repairs and routine maintenance services. Find out more. The cost of a car service is between and euros – depending on the make, model and how old the car is. The price also varies from workshop to workshop. Maintenance: $ per year ($66 per month). While costs vary with the vehicle, modest overall increases in vehicle maintenance come from engines using more. Getting your car serviced? Here's our guide to knowing what to look out for, and how much you can expect to pay. How much it costs to paint a car depends on several factors, including vehicle size and type of paint, but the average for a mid-range job is $1, to $4, vehicle over a five-year and 75,mile ownership period. The total cost of owning and operating an automobile include fuel, Maintenance, Tires, insurance. What affects the cost of a service? It turns out the reason for the difference is that the 40,km/24 month service requires the replacement of the spark. Car Service & Repair Cost Calculator · How much should you pay for your car servicing and repairs? · See the average price and savings for jobs on your car. Compare Car Servicing quotes in QLD. At AutoGuru, we let you search, compare and book from over qualified mechanics, who eat car troubles for. Graph and download economic data for Consumer Price Index for All Urban Consumers: Motor Vehicle Maintenance and Repair in U.S. City Average (CUSRSETD). Vehicle Detail Packages · Basic Refresh - Price Starting as low as $ · Enhanced Rejuvenation - Price Starting as low as $ · Ultimate Transformation -.

Win Real Money Instantly Free

InboxDollars; QuickRewards; MyPoints; Swagbucks; Brainbattle; Mistplay; CashOut; CashPirate Buzz; Blackout Bingo; 21 Blitz; Bubble Cash; Solitaire Cash; Pool. Results · Cashapp Money - Win Real Cash · Viva Vegas Slots Free Slots & Casino Games - Play Free Classic Las Vegas Slot Machines Online · Slots Win Real Money. Some of the best money-making games include Blackout Bingo, Dominoes Gold, Solitaire Cubes, Pool Payday, and Spades Cash. Compete in video game tournaments for cash prizes or play head to head for real money. Sign Up Now for Free Get up to a % match on your first deposit. What is the best game app that you don't have to pay for, but can win actual real money and cash out? How do those "free money" game apps make. This app will provide you with cash by performing daily tasks and earning points to be exchanged for real money. What Money Making Apps do you recommend for Android. Here are some of mine. JustPlay: Makes about 2 dollars every week. Play Slots For Real Money in NJMohegan Sun Online NJ Casino FREE. GET APP You can earn multiple entries into the giveaway, so come back every day to for your. Are you ready to take your Bubble Shooter skills to the next level and get a chance to win real money? Bubble Cash® is the top classic bubble shooter game for. InboxDollars; QuickRewards; MyPoints; Swagbucks; Brainbattle; Mistplay; CashOut; CashPirate Buzz; Blackout Bingo; 21 Blitz; Bubble Cash; Solitaire Cash; Pool. Results · Cashapp Money - Win Real Cash · Viva Vegas Slots Free Slots & Casino Games - Play Free Classic Las Vegas Slot Machines Online · Slots Win Real Money. Some of the best money-making games include Blackout Bingo, Dominoes Gold, Solitaire Cubes, Pool Payday, and Spades Cash. Compete in video game tournaments for cash prizes or play head to head for real money. Sign Up Now for Free Get up to a % match on your first deposit. What is the best game app that you don't have to pay for, but can win actual real money and cash out? How do those "free money" game apps make. This app will provide you with cash by performing daily tasks and earning points to be exchanged for real money. What Money Making Apps do you recommend for Android. Here are some of mine. JustPlay: Makes about 2 dollars every week. Play Slots For Real Money in NJMohegan Sun Online NJ Casino FREE. GET APP You can earn multiple entries into the giveaway, so come back every day to for your. Are you ready to take your Bubble Shooter skills to the next level and get a chance to win real money? Bubble Cash® is the top classic bubble shooter game for.

We offer a reward system, where you can earn real money by playing games on our platform. Our daily bonuses and rewards will keep you motivated and entertained. Get free money easily with Honeygain Honeygain lets you share your unused internet bandwidth to start making money with a few clicks. You can collect your. The best free app to win real money by playing classic mobile games such as Solitaire, Bingo, Pool, Blackjack, Bubble Shooter, and more. Be Rewarded For · How it Works · How You'll Earn Free Cash · Millions in Cash Rewards Paid · InboxDollars Reviews From Our Members · Partners You Know · InboxDollars. Top 10 Free Games That Pay Real Money Instantly · 1. Big Cash Web · 2. CashPiggy App · 3. Big Cash App · 4. Mistplay · 5. Blackout Bingo · 6. JustPlay. With the right free spins bonus, you can play online slots and win real money for free at all the best US online casinos. The oddschecker casino editorial team. Summary of How to Earn Free Money · Get paid for sharing your opinions with online surveys. · Make money by trying new products and services like FabFitFun. This free download money games app carries all games that pay real money instantly to you. Or you can play no download game by clicking "play online" button. We also give you some legitimate sites where you can play free games for real money! Sweepstakes and Social Casinos. Social casinos, sweeps casino sites, and. Solitaire Royale™ is the ultimate solitaire game where fast, fair, and fun gameplay meets real cash prizes. Download and play the game for FREE now! Test. Can you get real money from these games? Absolutely. Games like Bingo Cash and Solitaire Cash often pay as early as the next day, but timelines can vary. The. I use a very good survey app. Can also play games for cash but takes a lot longer for rewards to pend. Surveys are instant cash, make 27 in 2. Take your pick from the tasks on the earn page. We list the best offers from companies who want to advertise their apps, surveys, and products. Win real money online instantly and get speedy payouts at fast withdrawal casino sites. Our experts constantly test instant payout casinos in the USA and. 1. europe-tula.ru Repocket is an app that pays you for sharing your mobile data. · 2. InboxDollars. InboxDollars rewards you for web searches. Yes, you can win real money. The catch: You have to pay money yourself, and the money you pay in is almost always way more than you can actually. Play skill-based games on EazeGames and win real cash prizes. Learn fun ways to make money online! Make money online by watching ads, filling out surveys, playing games, writing comments, typing texts, answering questions, completing offers and more. Instant Win Games Reviews (No Free Games) · 10 Times Lucky · 7x Lucky · Alfredo · Aliens vs Hamsters · Battleship · Cash Arcade · Cash Cube · Cash Drop. Pool Payday is the top pool game app where you can play 1-on-1 pool games and win real cash prizes. This is a free game app where you can win real money taking.